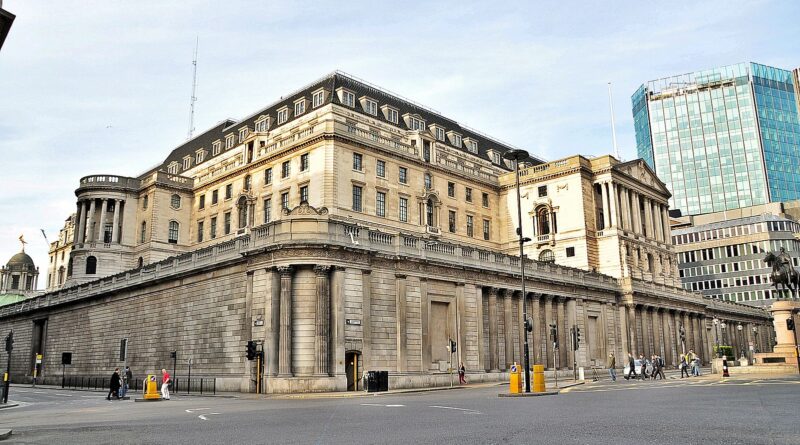

Bank of England considers creation of digital currency

The Governor of the Bank of England, Andrew Bailey, has spoken about the possibility of creating a central bank-backed digital currency in the near future.

The COVID-19 crisis has brought talk of a cashless society and digital currency surge, and the comments coming from the central bank of the UK confirm that such a reality isn’t far away.

“We are looking at the question of, should we create a Bank of England digital currency,” Bailey said in a webinar event with students.

“We’ll go on looking at it, as it does have huge implications on the nature of payments and society.

“I think in a few years’ time, we will be heading toward some sort of digital currency.

“The digital currency issue will be a very big issue. I hope it is, because that means COVID will be behind us,” Bailey said.

Digital currency has always been a contentious issue from a privacy and liberty standpoint given that it will inevitably be linked with a vast array of other applications and implications.

The implementation of digital currency implies the phasing out of cash and the obligation for citizens, either directly or through coercion, to participate in the full digitalization of society.

Digital currency would be a massive step towards more intrusion of one’s social graph through the more-than-likely requirement and collection of biometric data, health records, social profiles and other personal accounts.

MasterCard are already trialling an electronic payment system which requires biometric data combined with COVID-19 vaccinations for its use, which provides the starkest insight into what digital currency could lead to.