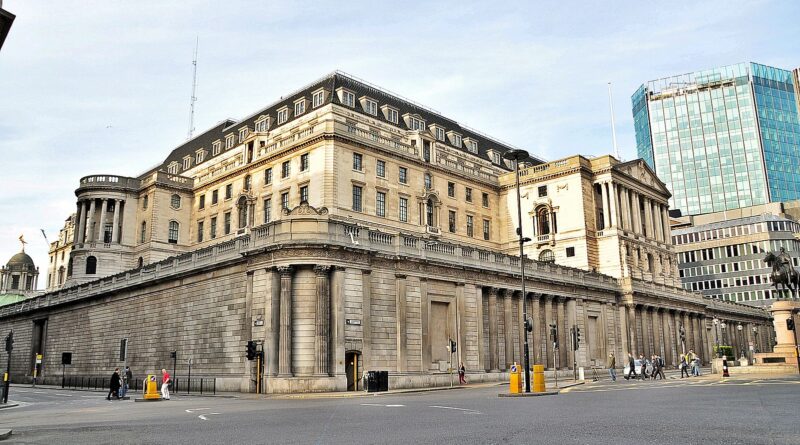

Bank of England sets wheels in motion for CBDC wallet

The Bank of England is now accepting applications for a ‘proof of concept’ CBDC Wallet to facilitate central bank digital currency transactions.

Through the UK government’s Digital Marketplace, organisations can begin to apply for tender to create a CBDC wallet for the Bank of England.

The wallet, as per the government’s criteria, should allow for payments to be carried out via account ID or QR code, while features include a “Freeze/Unfreeze wallet” function, among many others.

COVID-19 (of course) the pretext for CBDC

The Governor of the Bank of England, Andrew Bailey, spoke for the first time about the possibility of creating a central bank-backed digital currency back in July 2020, with COVID-19 as the justification, and now those plans are fully in motion.

“We are looking at the question of, should we create a Bank of England digital currency,” Bailey said in a webinar event with students.

“We’ll go on looking at it, as it does have huge implications on the nature of payments and society. I think in a few years’ time, we will be heading toward some sort of digital currency.

“The digital currency issue will be a very big issue. I hope it is, because that means COVID will be behind us,” Bailey added.

Another conspiracy theory come true

The implementation of digital currency implies the phasing out of cash and the obligation for citizens, either directly or through coercion, to participate in the full digitalization of society.

Digital currency would be a massive step towards more intrusion of one’s social graph through the more-than-likely requirement and collection of biometric data, health records, social profiles and other personal accounts.

This is something that Bigtechtopia has long warned about when it was still being dismissed as a farfetched conspiracy theory. Now, it is very much under development.

“If the results of this ‘development’ phase conclude that the case for CBDC is made, and that it is operationally and technologically robust, then the earliest date for launch of a U.K. CBDC would be in the second half of the decade,” said the central bank.

Links with BIS

Interestingly, one of the stated reasons behind this project is to “support the Bank’s work towards the BIS Innovation Hub’s ‘Project Rosalind’”. Yet given the comments made by a top BIS executive about the purpose of these digital currencies, it should raise serious alarm.

The General Manager of BIS (Bank for International Settlements) Agustin Carstens, in October 2020, made a frightening statement about the intentions of CBDCs.

“We don’t know who is using a $100 bill today and we don’t know who’s using a 1,000 peso bill today,” he said.

“The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.”